4 Experts on the Future of London Tech

London has established itself as a global tech powerhouse. How will the city make the most of this movement to ensure prosperity for businesses and talent?

Our Story

Learn about who we are, our vision and how we’re changing the future of work.

Testimonials

Hear from our students on how BrainStation has helped them build successful careers.

Careers

Looking to join our team? View our open positions across the globe.

Press and Media

Resources and contact information for our media partners.

BrainStation’s Data Science Diploma is an intensive program designed to launch students’ careers in data. To further showcase what can be accomplished after a 12-week diploma program, we spoke with Andres Jaramillo, a recent BrainStation graduate to learn more about his capstone project.

Jaramillo wanted to complement his background in digital marketing with the ability to leverage data. “I decided to pursue data science to learn more sophisticated tools to prepare myself for the future landscape surrounded by data.”

Inspired by stories of successful traders, and particularly traders who’d made millions only to lose everything, he decided to build an automated Quantitative Financial Algorithm. One that was able to play in the stock market … and win.

The model and process are explained in-depth in Jaramillo’s portfolio, but here are some key takeaways:

“I’ve always found it interesting hearing stories about successful traders who managed to beat the market. Quantitative trading is one of the many possible strategies available for doing so, but I think the word quantitative scares “non-technical” traders from trying it out,” Jaramillo said.

“I thought this project could be a great introduction to financial markets and their machine learning applications, while also practicing my data science skills.”

To start, Jaramillo designed a framework – a skeletal model with a robust infrastructure. His aim was for the model to be unbiased, fully automated, able to beat the S&P500 growth rate, and have long-term exponential growth.

Next, he had to build a strategy. “I don’t have a financial background, so creating a buying and selling strategy took multiple attempts.” But, he said, this worked to his advantage. “I didn’t approach this project as a typical investor who acts on knowledge because that involves a bias that may lead to missed opportunities.”

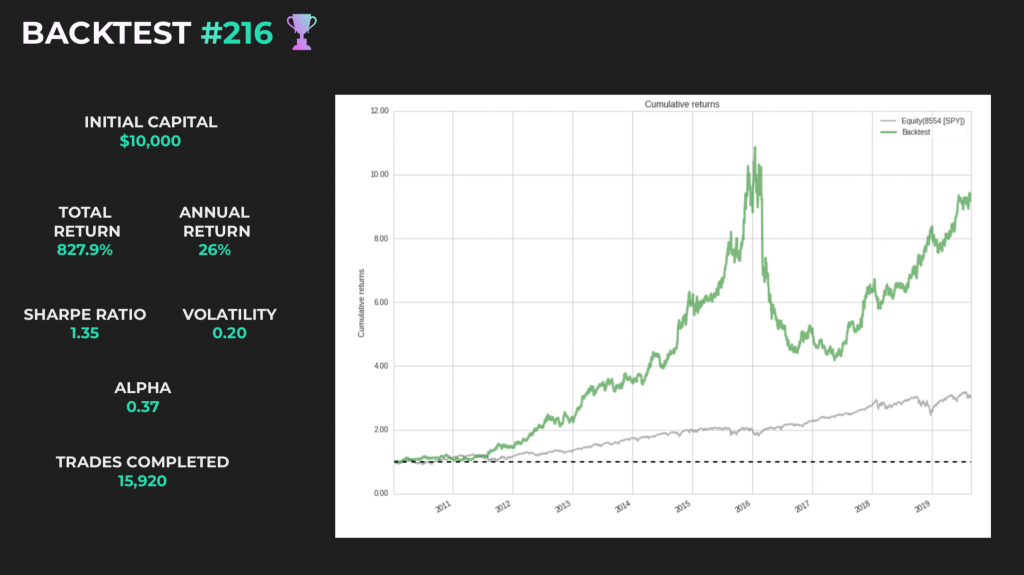

Then, of course, it was time to test the algorithm. Jaramillo backtested his models on historical stock data and found that the algorithm was a success, returning a rate of 827.9% within nine years.

“The key lesson I learned [at BrainStation] was how to approach solving problems as a Data Scientist. Without this methodology learned, I would have quickly felt overwhelmed and disheartened at the start of my project,” he said.

Get the latest on upcoming courses, programs, events, and more — straight to your inbox.

You have been added to our mailing list, and will now receive updates from BrainStation.